If you are in the market to buy, sell, or upgrade, now is a great time to do so. Rising interest rates affect purchasing power greatly, as outlined below by Triplemint’s good friend Elise Leve of Citizens Bank:

Purchase Rate: $1,000,000

Down Payment: $200,000

Mortgage Amount: $800,000

Interest Rate: 4.125%

Term in Years: 30

Monthly Mortgage Payment: $3,877

ANTICIPATED 2019 RATE INCREASE:

New Higher Rate: 5.125%

New Higher Monthly Payment: $4,356

Additional down payment required to get monthly payment back down to $3,877: $87,917

The size the mortgage would have to be to get the payment back down to $3,877: $712,083

The new purchase price using the original down payment of $200,000: $912,083

The increase in rate will reduce your purchasing power by 9%

Read our December Market Update below!

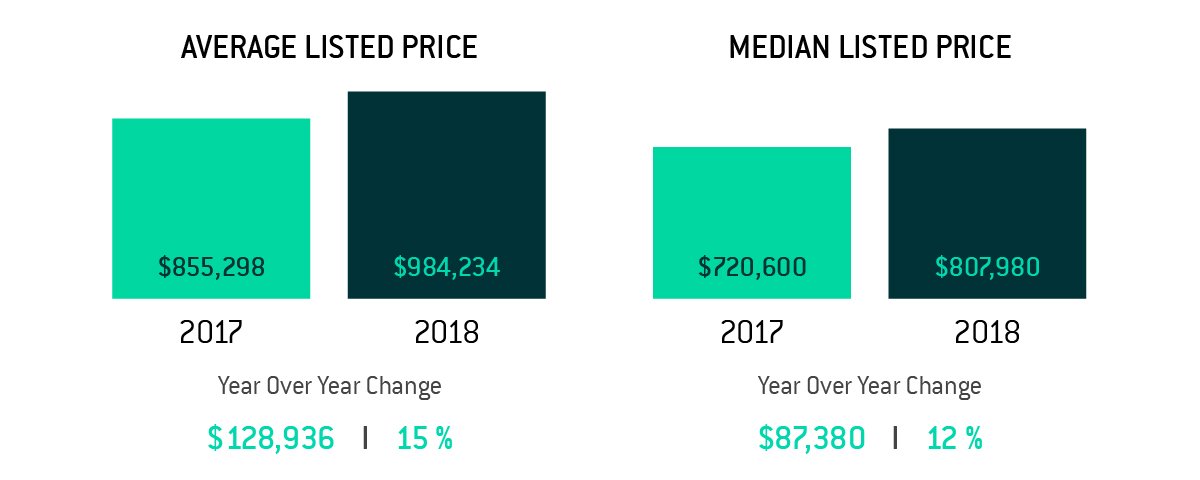

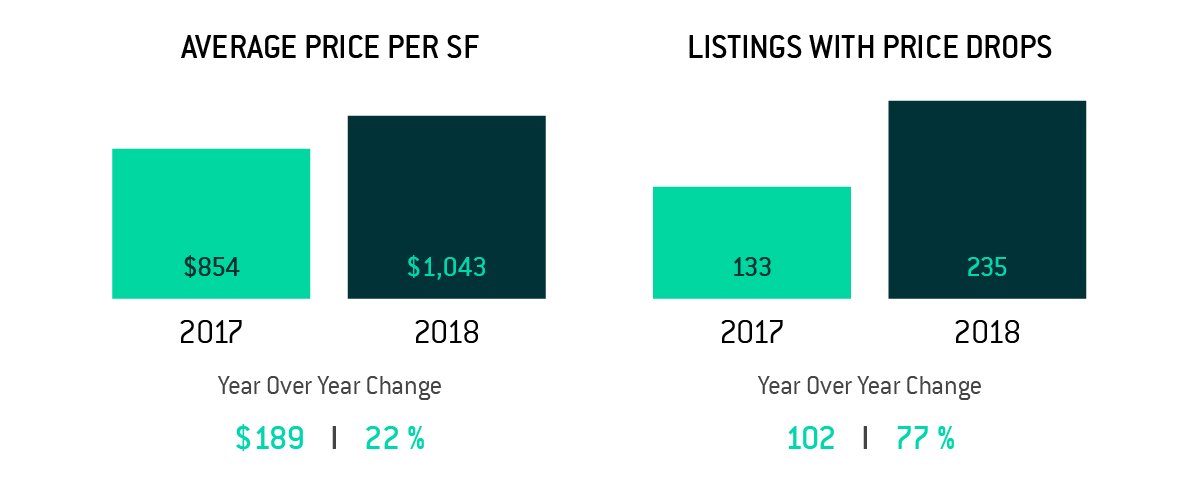

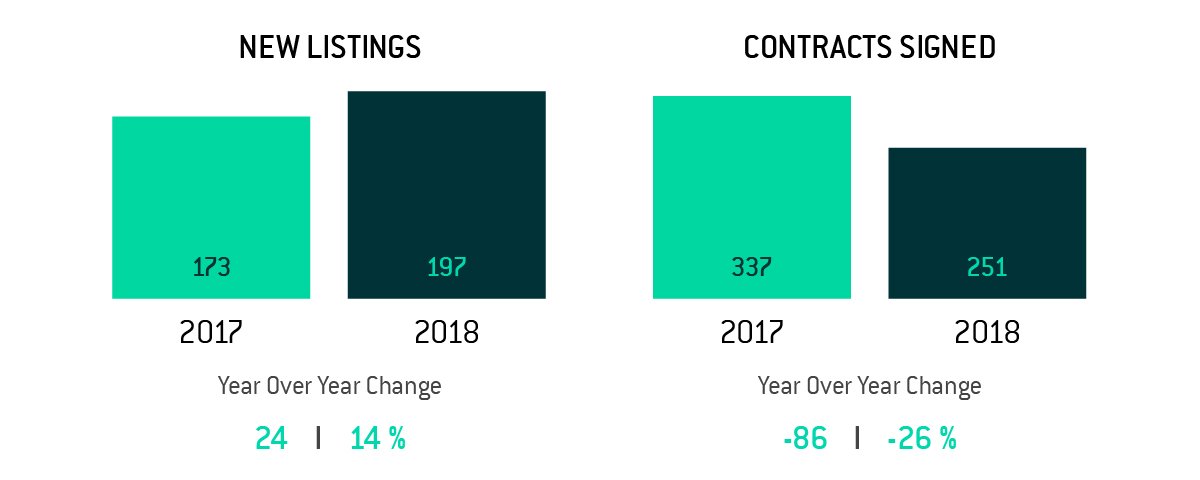

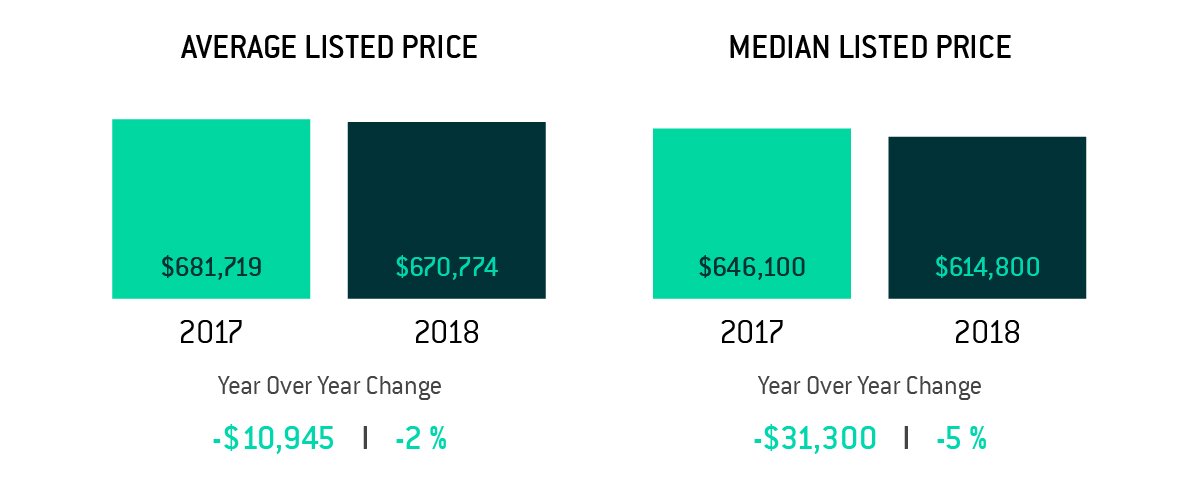

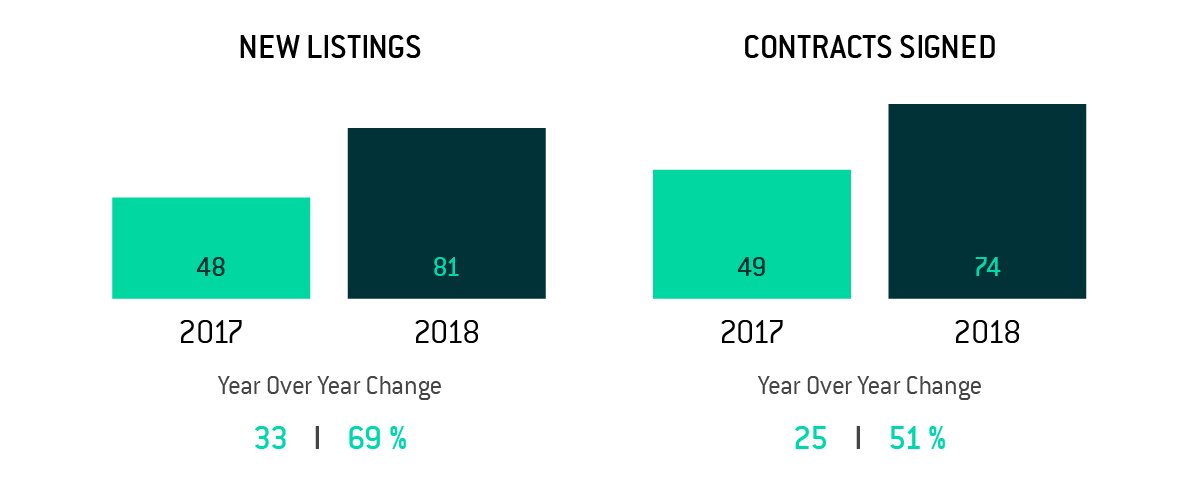

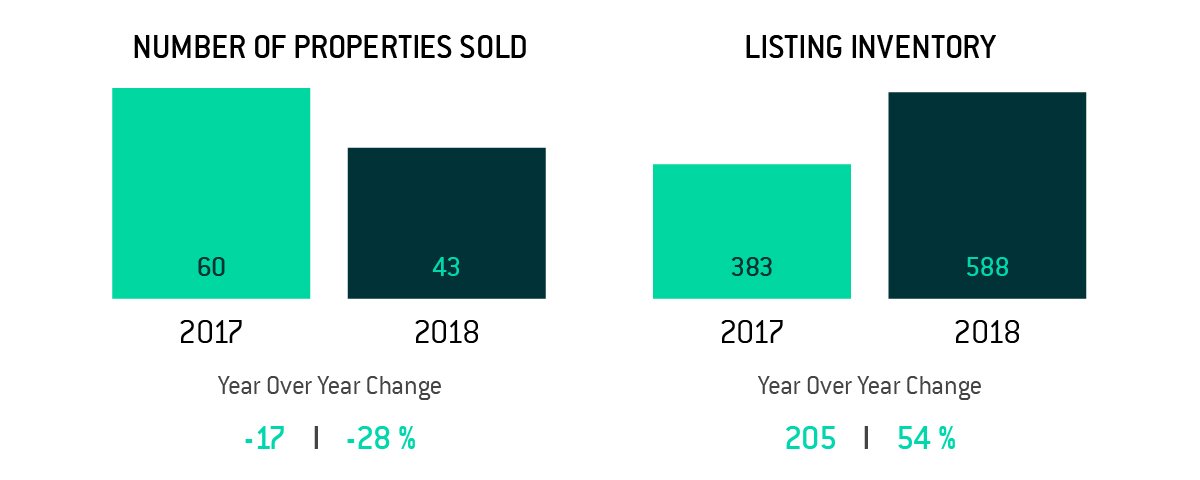

Data courtesy of OLR Market Pulse and current as of 12/13/2018.