You did it – finally saved up that 20% down payment for your dream apartment. First of all, congrats! (No, really, is it just me or is a lack of a proper savings account normal in New York City? Just me? Okay, great.) Anyways, back to you. You’ve had your eye on Boerum Hill 2 beds for a while now, and TripleMint’s newest exclusive at 560 State Street fits every one of your needs. It’s priced extremely competitively at $1,500,000, and your $300,000 down payment is begging to be spent.

Before you go to the bank and ask the teller for 300,000 one dollar bills*, I have some bad news. You’re not quite ready to purchase the apartment. There are a lot of other upfront costs associated with the purchase of an apartment, and sadly I’m not referring to your moving expenses.

For the purpose of this explanation, and because I can’t stop drooling over it, let’s go back to 560 State Street.

The Down Payment: $300,000

In New York City, the standard minimum down payment required to purchase an apartment will be 20%. You knew this, you saved it, what’s next?

NYC Real Estate Attorney Fees: $3,000**

You’ll need a Real Estate Attorney to finalize the contract of the sale, and to review the financials of the building before you sign anything. This will cost you anywhere from $2,500-$6,000 depending on the situation and of course, the attorney that you use.

Building Fees: $1,450:

You know those application and move in fees you’ve been paying for your rentals all these years? Those don’t go away. At 560 State Street, you will pay a $1,000 fee for the closing of the sale, along with a $450 fee if you close on the sale with financing. On average, you can expect to pay about $1,500.

Mansion Tax: $15,000

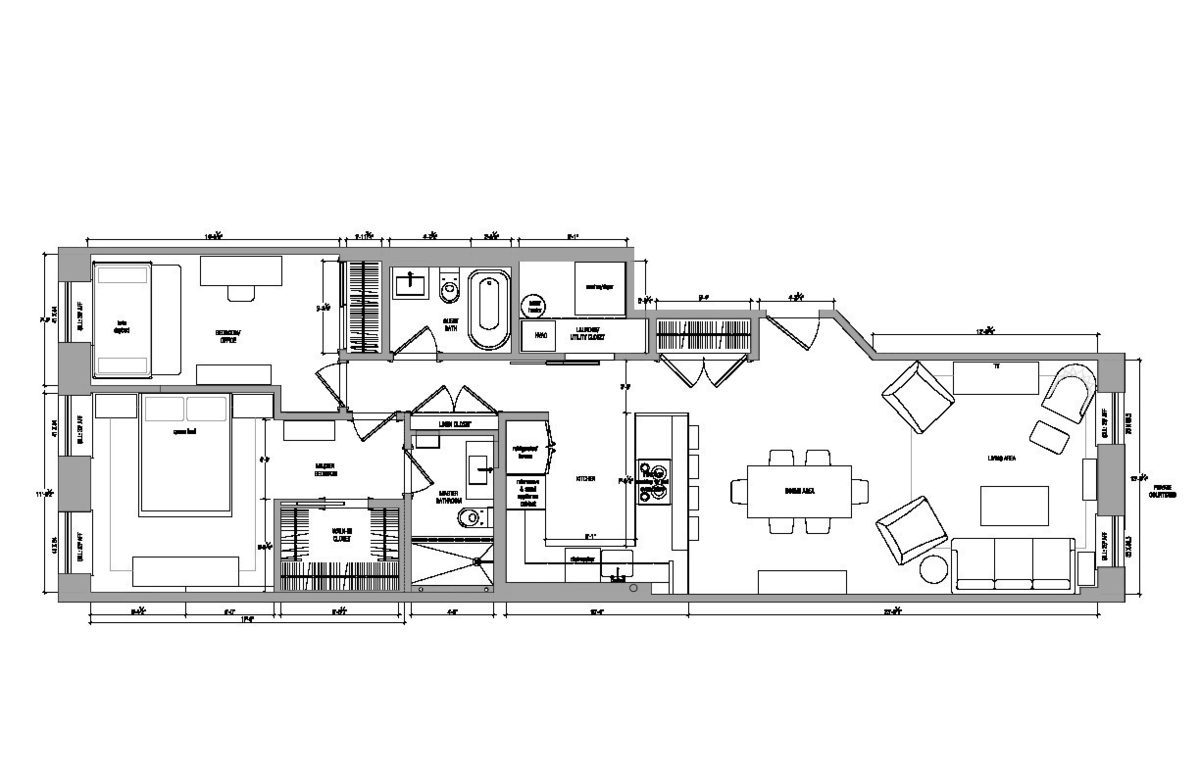

Luckily 560 State Street is over 1,000 square feet, which is huge by New York City standards, but it still feels almost painful to call anything in New York City a mansion. According to federal standards, however, if the purchase price is $1,000,000 or higher, it’s a mansion – and you’ll have to pay a 1% tax on it. It’s a one time tax paid at the time of the purchase, but that doesn’t make it any less painful.

Post Closing Liquidity: $23,318***

Though this technically is not an amount you will have to pay, you’ll need to have it in your bank account at the time of purchase. Essentially, the building’s board will not want to see that the purchase of the apartment completely wiped you out financially. In order to make sure you’ll be able to afford the costs associated with living in the apartment, boards will look for up to 2 years of monthly payments in liquid assets. At 560 State Street, common charges are $466.83 monthly, and taxes are $504.73.

Total Required at the time of Purchase: $342,768

So, there you have it. If you only have the $300,000 down payment saved up, you’re about 87.5% of the way there. If 560 State Street is as perfect to you as it is to me (seriously mom, please buy me this apartment), then I suggest finding that extra $42,768 as quickly as possible. I mean, come on, do you see this place?

*Please do not attempt to pay for an apartment in one dollar bills, but please always use one dollar bills when making it rain, for dramatic effect.

**Real Estate Attorney Fees are estimated at industry averages.

***Post closing liquidity requirements differ from board to board, and are estimated at 2 years of monthly payments conservatively.